Thus, in Florida, the priority lien could allow the HOA to collect up to 12 months of unpaid common charges. Its statute states that the HOA can collect the lesser of (a) any unpaid common charges and other common periodic assessments that occurred within the previous 12 months before the transfer of title took place or (b) 1% of the original mortgage debt. §47-258(b) to allow HOAs to collect up to 9 months of unpaid common charges by means of the priority lien.įlorida is the other state that had enacted legislation to this effect prior to 1/14/14.

Fannie Mae has said that if a state has enacted legislation prior to 1/14/14 that allows an HOA to collect more than 6 months of unpaid common charges, these states will be grandfathered in and allowed to exceed the statutory 6 months.ĭuring the last legislative session in 2013, the Connecticut General Assembly amended Conn. Yes, there are exceptions and one of them is in my state of Connecticut. This announcement by Fannie now limits the number of months that an HOA can collect to 6 months of common charges. If the HOA is allowed to collect years of unpaid common charges, Fannie and the lender are out even more money. On the other hand, Fannie Mae and the lenders are already running the risk of losing money by acquiring the home through foreclosure. Because the HOA runs on a budget based on certain expectations of income, one or more of these situations could pose a serious financial threat to the HOA. This would mean that the HOA is owed months, if not years of uncollected common charges. During this time, it is highly unlikely that the unit owner would be paying the common charges. The existence of priority liens and the protection that the liens offer vary greatly from state-to-state.įoreclosure actions can take a year or longer to complete. Often, the lender will pay the delinquent common charges and add them to the unit owner’s mortgage loan amount. In fact, a lender runs the risk of being “foreclosed out” if the HOA begins a foreclosure and there is no equity left over to pay the lender. This also allows an HOA to initiate a foreclosure action if a unit owner fails to pay his/her monthly common charges. This means that out of the funds collected as a result of the foreclosure, the HOA would get paid before any money is disbursed to the first mortgage lender, any subsequent mortgage lenders or any other entity that has placed a lien on the home. When a unit is foreclosed, the liens are paid in their order of priority. Also called “super liens”, these liens allow the HOA’s common charges to the unit owner (also commonly referred to as monthly “association dues”) to take priority over a first mortgage lien. That was a mouthful, wasn’t it? Let me break it down…Ī unique feature of condominiums and planned communities is that the homeowner’s association (HOA) can have a priority lien over any mortgages that encumber a unit. More recently, however, it revised this policy to allow states who had enacted legislation allowing a greater priority than 6 months to be “grandfathered in” if the legislation preceded Fannie’s announcement on January 14, 2014.

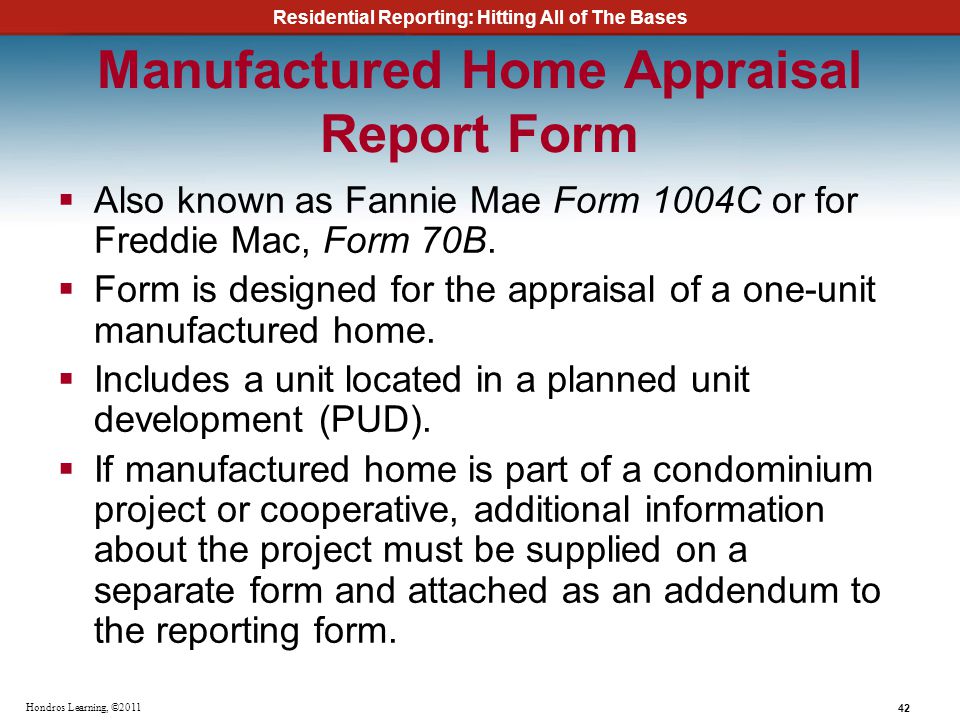

On January 14, 2014, Fannie Mae had announced that the maximum priority lien held by condominiums and planned communities (PUDs) may be no more than 6 months.

DOES FREDDIE MAC ALLOW A LIMITED CONDO REVIEW FOR ATTACHED PROJECTS FULL

But you sort of have to blend the first 2 quarters together to really get - have a full picture, and that picture’s a very good one.Fannie Mae Revises Policy of 6-Month Condo Priority Lien But we expect that CareerBuilder will have a strong quarter in the third quarter again. Now we’ll also have promotional spending on a more consistent basis into the third and fourth quarters, unlike last year.

So I think it’s just a different factor that occurred between the first and second quarters, which is dramatically different. So - but if you look at what - if you combine the first and second quarters for CareerBuilder, what you would see is that their bottom line is up in the double digits and margins are very strong. They did not participate in the Super Bowl this year, and in fact, I think their - that their spending and promotional and marketing is going to be more staggered through the course of the year, which is different than it was last year and prior years. On the Digital - on CareerBuilder, as you may recall, traditionally, CareerBuilder spent a lot of their marketing and promotion dollars and - particularly tied to the Super Bowl in the first quarter of the year. Let me take the last question first while Victoria is looking at a couple of notes.

0 kommentar(er)

0 kommentar(er)